As is already known, the Government of the Republic of Srpska recently launched an initiative to introduce a differential VAT rate for basic nutrition products – a standard 22% rate and a lower rate of 10%.

The government has stated that the main goal of the initiative is to improve the position of socially disadvantaged residents by lowering the cost of basic supplies.

It is of course known that the government also plans to decrease the social contribution tax rate by 1.4% (as planned in the “Law on changes and amendments to the law on social contributions”), so the proposed changes to VAT policy also aim to compensate for the corresponding fall in revenues. These two initiatives have been proposed simultaneously. At the same time, the government is proposing a new special excise tax on cigarettes (0.30 BAM per pack of cigarettes) and additional excise tax on beer (0.15 BAM per liter). Both taxes are expected to raise additional revenues.

These measures are in line with recommendations that GEA has been advocating for a long time. It is necessary to restructure the tax burden with an aim towards decreasing income taxation – one of the most damaging forms for economic growth and employment – while considering raising taxes with less damaging effects, such as taxes on consumption and property. Our previous press releases on this subject can be found here, along with the study named “How to achieve lower income taxes without harming public funds”.

We have also recently written that the decrease in labor taxation should be significantly higher than the proposed 1.4% in order to achieve a significant impact on the labor market.

However, lurking within the proposal to introduce a differential VAT rate lies a serious danger. What is this danger? We warned about it back in 2011, following the announcement of this same proposal by the Government of the Republic of Srpska.

Here, we explain once again this danger along with several further arguments against the differential VAT rate:

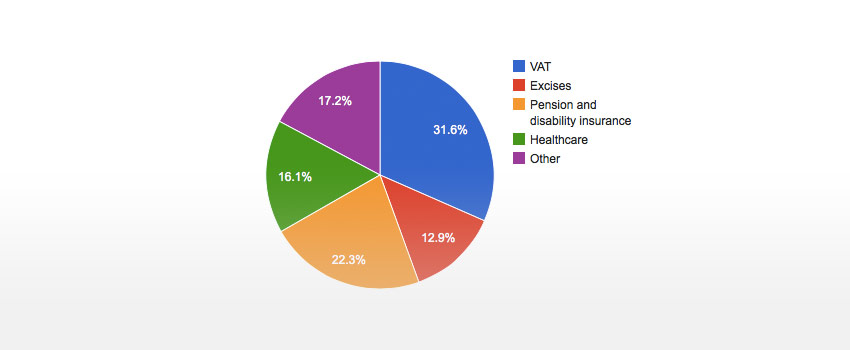

Firstly, the introduction of differential VAT rate complicates the entire tax system in multiple ways and undoubtedly invites further tax evasion. For example, a baker will have financial motive to register the sale of their cookies as the sale of bread (with the lower tax rate) in order to pay less VAT amount, while retaining the right to an entire VAT refund. The experiences of Great Britain, Switzerland and many other countries have proved that multiple VAT rates pose a serious problem, even for developed countries. The study by the Department for macroeconomic analysis of the Governing Board of the Indirect Taxes Administration of B&H “On the implications of differential VAT rates for B&H” further elaborates on this issue. The study states that the abolition and reduction of taxes have allowed EU member states to collect only 55% of potential VAT revenue. The EU has therefore decided to devise a new VAT strategy. The European Commission recommends a system based on a single VAT rate, a wide tax basis and minimal tax abolition. The study concludes that “the VAT system in B&H is very close to the ideal model advocated by the EU.” The current abundance of VAT revenues surely confirms this thesis – by far the biggest source of tax revenues in B&H. According to 2014 data, VAT revenues amounted to 3.2 billion BAM annually, which was 31.6% of total tax revenues for all levels of government in B&H (see chart below).

Sources of data: The Department for Macroeconomic Analyses of the Governing Board of ITA B&H and the Directorate for Economic Planning of B&H

As we have warned, it is extremely difficult to estimate the fiscal effects of introducing multiple VAT rates, given the limited availability of data on the structure of domestic consumption and the inability to predict how the much more demanding legal, implementation and tax oversight conditions of multiple VAT rates will impact the entire tax system. Simplicity is a significant advantage of the existing VAT system, while a multiple rate regime recalls the drawbacks of the real trade tax.

Therefore, the proposal to introduce a differential VAT rate in B&H can be compared to “opening Pandora’s Box.” The experiences of other countries also clearly demonstrate that the introduction of multiple VAT tax rates tends to be followed by strong political pressure to add more and more products to the lower tax rate list, resulting in the gradual expansion of the list and further erosion of the potential of VAT to generate revenue. The fact that a large number of European countries have multiple VAT rates does not mean that it is the best solution. It simply confirms the claim that it is difficult to retreat from this policy once multiple VAT rates are introduced.

It is also widely known that decreasing tax rates on food products often does not lead to a proportional decrease in their prices, given the firm demand for these products and the tendency of sellers to increase profit margins. Therefore, the social impact of this policy measure is extremely limited, especially considering that wealthy populations consume the same products in greater quantities than the socially disadvantaged. The OECD study concluded that “single VAT rates, combined with direct transfers to the poor, are far more effective than using differential VAT rates for realizing the goals of distribution.” Considering the higher amount of revenue that can be collected from a single VAT rate, the European Commission also recommends assisting poor populations via a the system of targeted transfers, which can have much greater impact than VAT tax reductions.

We recommend that serious consideration be given to withdrawing the proposal to introduce a differential VAT rate. Again, estimates of potential revenues from this initiative are extremely unreliable. Although reliable estimates can be made regarding potential revenues resulting from an increase in the single VAT tax rate, such an increase is justifiable only if a radical decrease in income tax rates is introduced at the same time – a decrease that is much greater than the proposed 1.4% of gross wages). In this case as well, the goal should be decreasing the joint tax burden (taxes on consumption plus income taxation) – enabled through savings in public budget expenses, primarily in the area of administration costs.

In this context, we would fully support the proposal to introduce special consumption taxes such as additional excise taxes on cigarettes and beer.