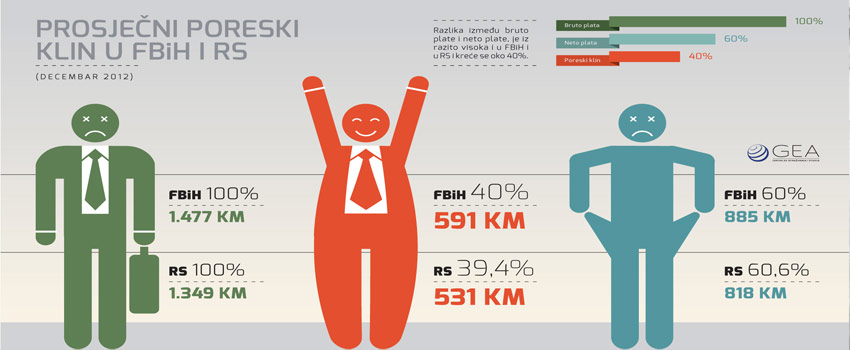

It is well-known that B&H’s 40% “tax wedge” – the amount of taxes and contributions on income – is relatively high when compared with that many countries. This means that for every 100 BAM that an employer pays for one registered worker, only 60 BAM goes to the worker.

In the Republic of Srpska, the tax wedge on an average monthly wage is 39.7%, while in the Federation of Bosnia and Herzegovina it is 43.8%, meaning that B&H has the highest tax wedge in the region when compared with Serbia, Slovenia, Macedonia, Montenegro and Croatia).

The announcement by the Government of the Republic of Srpska to introduce a 200 BAM tax-exempt portion of wages, reducing the tax wedge by 1.5 % to 38.2%, is surely a welcome measure. This tax exemption is clearly insufficient, however, when we consider policies being adopted by neighboring and EU countries in their attempts to tackle the dire state of the labor market and macroeconomic trends.

Like most European countries, those in the Western Balkans tend to maintain relatively high levels of income taxes. Among EU countries, the average tax wedge is 39.9%, led by Belgium with 50.5% and Hungary with 47.6%.

During the current global economic crisis, however, such high income tax levels have contributed to declining economic growth and rising unemployment. By contrast, the average US tax wedge is 27.4% while in Israel it is 20.2%, Korea 19.8%, New Zealand 16.9%, Mexico 15.5% and in Chile only 7%! Switzerland also has relatively low rate, of 18.6%.

The European Commission has recently proposed the possible creation of new tax structures in Europe that would be more “friendly” towards economic growth. In its report for the Parliament of Europe, the European Commission states that tax structure greatly impacts a country’s economic growth and highlights income taxes as most damaging to growth. Taxes on consumption are viewed as less damaging than income taxes, with property taxes least damaging. The report goes on to recommend that “moving taxation away from labor should be the priority for most EU members, which would be aimed at stimulating the demand for labor and creating new workplaces.” The European Commission suggests that increasing consumption taxes could be a way to replace income that would be lost through the decreasing taxation of labor. It notes that EU member states have already begun this process by increasing VAT and excise tax rates.

Prompted by increasing levels of unemployment and the need to boost international competitiveness, countries in the region including Croatia and Serbia have already decided to adopt “fiscal devaluation” – policies to decrease labor taxes while increasing consumption taxes (for example VAT). Such policies tend to prompt currency devaluations due to falling domestic workforce costs and rising costs for imported products and services. These measures are considered to be especially effective for countries with fixed exchange rates and single VAT rates. B&H is one of the few countries that meets both these conditions.

To be clear, an income tax decrease without an increase in other taxes would be the optimal solution to help tackle weak economic growth and unemployment. Significant tax cuts on labor income are not currently possible, however, without making up for some of the public revenue losses without some increase in consumption tax, for example.

Center for Research and Studies GEA has explored possibilities for such tax reforms in B&H. The findings and recommendations from our research are presented in a study called “How to achieve lower income taxes without harming public funds?”. We document how income that would be lost in short term as a result of income tax cuts can be compensated via indirect taxation, in such a way that maintains or even reduces the overall tax burden.

According to calculations based on 2012 data, a mere 1% VAT rate increase would generate up to 186 million BAM of additional public revenue in B&H. It would thereby be possible to implement a 5% income tax rate cut in FB&H, for example, and a 300 BAM monthly wage tax exemption. If revenues generated from the VAT tax increase were used to reduce the tax burden for one third of all employees with the lowest wages in FB&H and RS, it would be possible to lower their tax wedge by more than 9%. That would enable an increase in their net wage of over 16%, while labor costs for the employer remain the same.

Decreasing income taxes proportionally to a 1% VAT rate increase is only given as an example here. However, we suggest serious consideration of decreasing taxes and contributions on wages beyond the income neutral level as well. This would be possible if one portion of funds needed for such reform would be ensured through fiscal savings, which we find possible for the entities’ budgets.